As we review the Toronto real estate market conditions in May 2024, several key trends have emerged, offering both challenges and opportunities. While the market has experienced a decline in home sales compared to the previous year, this adjustment provides an advantageous scenario for buyers, particularly those entering the market for the first time.

Increased Market Accessibility and Buyer Advantages

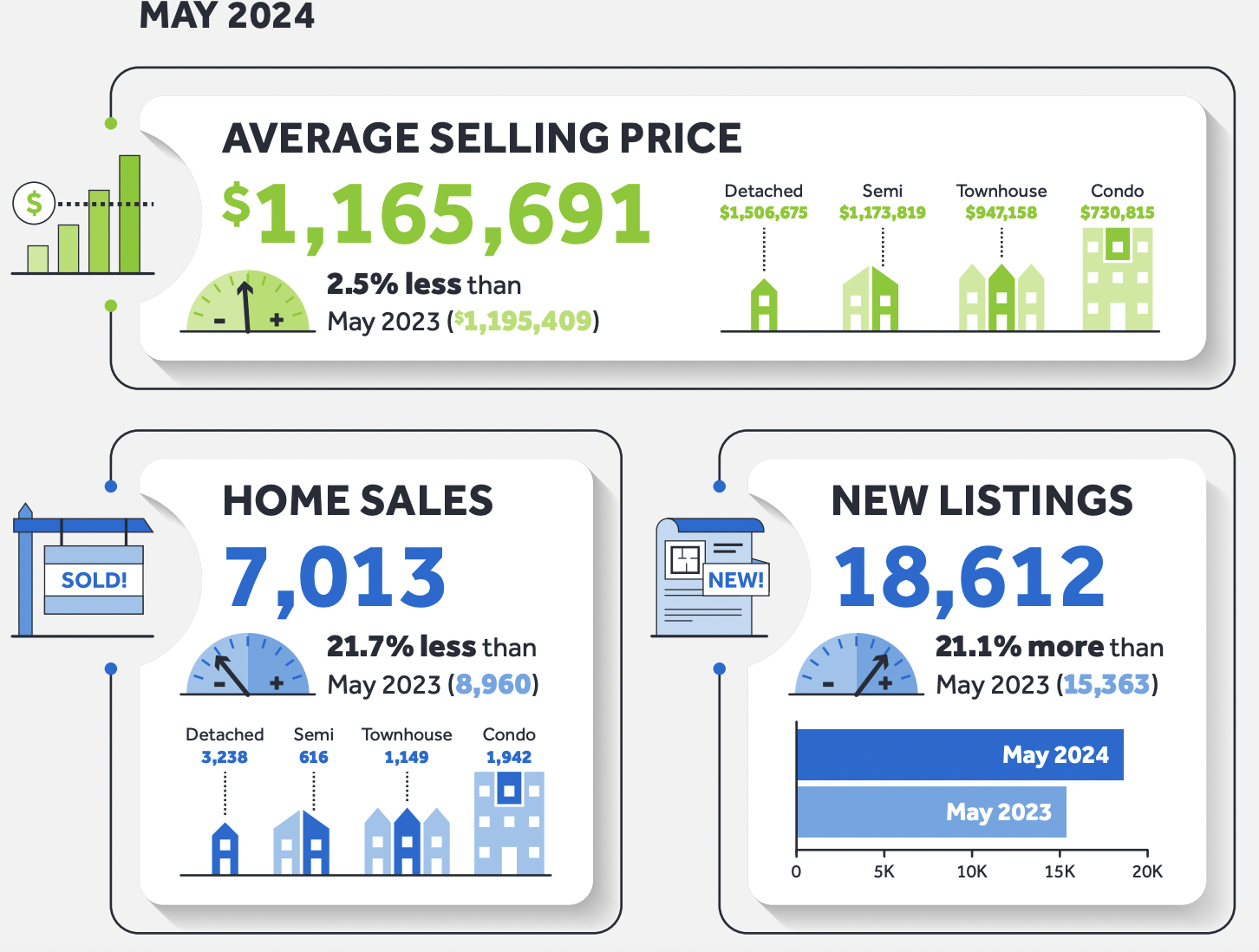

In May 2024, the Greater Toronto Area recorded a 21.7% decline in home sales year-over-year, as reported by the Toronto Regional Real Estate Board (TRREB). However, this slowdown was accompanied by a 21.1% increase in new listings compared to May 2023. This growth in available properties means prospective buyers with a broader range of options and less competition, creating a buyer-friendly environment. This trend benefits buyers by providing more opportunities to secure homes, potentially leading to better deals and more favorable purchase conditions.

Mortgage Rates - borrowing becomes more affordable

A significant development that impacts the market is the recent decision by the Bank of Canada to cut its benchmark interest rate by 0.25%, setting it at 4.75%. This is the first adjustment after six consecutive holds. This reduction is expected to directly benefit homeowners with variable-rate mortgages and other debts linked to the policy rate, who will see their interest rates decrease by 25 basis points. This decrease in rates, highlighted by Bank of Canada Governor Tiff Macklem as considerable progress in managing inflation, is good news for Canadians and is expected to encourage more buyers into the market, including first-time buyers, to enter the market as borrowing becomes more affordable.

Pricing Trends and Future Market Dynamics

In May 2024, the average selling price in the GTA slightly decreased by 2.5% from the previous year to $1,165,691. While this reflects a slight downturn, TRREB Chief Market Analyst Jason Mercer anticipates that as borrowing costs continue to trend lower, affordability will improve. However, as demand begins to rebound, we might see prices rise again due to increased competition among buyers. This dynamic suggests that the present might be a strategic time to consider entering the market before prices potentially start climbing again.

Long-Term Strategic Planning and Infrastructure

TRREB CEO John DiMichele emphasizes the importance of strategic long-term planning and government coordination to address the housing deficit and support the region’s growing population. The focus on enhancing infrastructure, such as the completion of the Eglinton Crosstown LRT, is crucial for sustaining the economic health and livability of the GTA. These developments will likely boost property values in affected areas, presenting potential long-term benefits for investors and homeowners.

The current landscape of the GTA real estate market offers a unique window of opportunity. The increased availability of properties and the recent easing of mortgage rates present optimal conditions for buyers. As a real estate broker, I am here to provide the latest market insights and expert advice to help you make informed decisions. Let's discuss how these current conditions can be leveraged to meet your real estate objectives, whether you're buying, selling, or investing.

For more insights and assistance with navigating the GTA real estate market, feel free to reach out or consult our latest analyses and expert advice tailored to your specific needs and goals.

#gtarealestate #realestate #Torontohousingmarket #realestateanalysis #realestateupdate #BankofCanada #GTApropertybuyingtips #Realestateinvestmentopportunities #investmentopportunities #GTAmarketinsights #GTArealestatebroker #Torontorealtor